Business Story

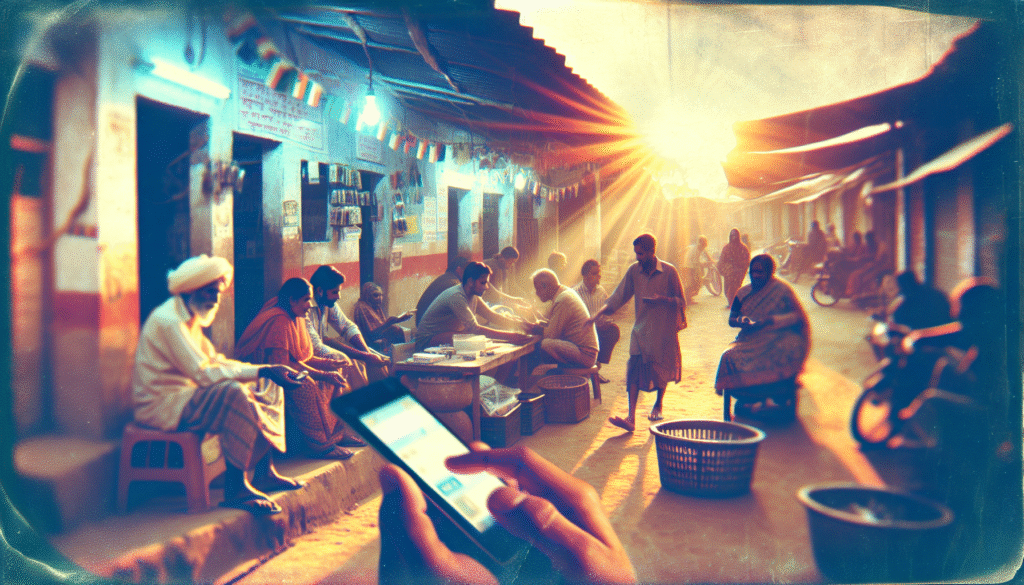

Fintech Innovations: Transforming Financial Inclusion in Rural India

How digital finance is unlocking economic empowerment across India’s rural heartland.

The Rural Financial Divide

India’s rural population, comprising over 65% of the nation’s total, has historically faced limited access to formal financial services. Challenges such as geographical remoteness, lack of documentation, and low financial literacy have contributed to this divide. However, the advent of fintech innovations is reshaping this landscape, bringing banking, credit, and insurance services to the doorsteps of rural communities.

Digital Payments: The Catalyst for Inclusion

The proliferation of mobile technology and internet connectivity has paved the way for digital payment platforms to thrive in rural areas. Unified Payments Interface (UPI), Aadhaar-enabled Payment Systems (AePS), and mobile wallets have become instrumental in facilitating seamless transactions. These platforms not only offer convenience but also reduce the dependency on cash, enhancing transparency and security in financial dealings.

Microloans: Empowering the Underserved

Access to credit has been a significant hurdle for rural entrepreneurs and small-scale farmers. Traditional banking institutions often hesitate to extend loans due to perceived risks and lack of collateral. Fintech companies are addressing this gap by leveraging alternative credit assessment methods, such as analyzing transaction histories and mobile usage patterns. This approach enables the provision of microloans to individuals who were previously deemed unbankable, fostering entrepreneurship and economic growth.

Insurance: Safeguarding Livelihoods

Insurance penetration in rural India has been minimal, leaving many vulnerable to unforeseen events. Fintech startups are introducing microinsurance products tailored to the specific needs of rural populations. These offerings cover areas such as health, agriculture, and life insurance, providing a safety net that can prevent individuals from falling into poverty due to unexpected circumstances.

Government Initiatives and Policy Support

The Indian government has recognized the potential of fintech in promoting financial inclusion and has implemented policies to support its growth. Initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) have aimed to provide every household with a bank account. Additionally, regulatory frameworks have been established to ensure the security and reliability of digital financial services, encouraging both providers and users to engage with these platforms.

Challenges and the Road Ahead

Despite significant progress, challenges remain in achieving comprehensive financial inclusion in rural India. Issues such as digital literacy, infrastructural limitations, and cybersecurity concerns need to be addressed. Collaborative efforts between the government, fintech companies, and community organizations are essential to overcome these hurdles. Investments in education and infrastructure, along with the development of user-friendly technologies, will play a crucial role in ensuring that the benefits of fintech reach every corner of rural India.

Final Analysis

Fintech innovations are transforming the financial landscape of rural India, offering tools and services that empower individuals and communities. By bridging the gap between traditional banking systems and underserved populations, fintech is not only fostering economic development but also promoting social equity. As these technologies continue to evolve and expand, they hold the promise of a more inclusive and prosperous future for rural India.

#FintechForInclusion

#DigitalIndia

#RuralEmpowerment

#Microfinance

#DigitalPayments

#FinancialInclusion

#FintechInnovation

#RuralBanking

#TechForGood

#InclusiveGrowth